BLOG

Breaking Ground: The Smart Way to Finance Land Ownership

Breaking Ground For those seeking to build a custom home, start a farm, or invest in real estate, purchasing land can be a smart, forward-thinking move. However, unlike traditional mortgages, land loans can be complex and often misunderstood. A land loan—used to finance the purchase of a parcel that doesn’t yet have a livable structure—comes with unique requirements, higher down payments, and more scrutiny from lenders. Understanding the nuances of land financing, including lender expectations, interest rates, and zoning laws, is essential for anyone considering this pathway to ownership.

The Types of Land You Can Finance Breaking Ground

Before applying for financing, it’s important to understand the different types of land you might purchase. Raw land refers to undeveloped property with no utilities or infrastructure—often the cheapest but riskiest investment. Then there’s unimproved land, which may have some access to utilities but still lacks a structure. Lastly, improved land is typically ready for development with roads, electricity, and water lines in place. The type of land you choose will significantly impact your financing options and loan terms.

Lenders view raw and unimproved land as high-risk assets due to their undeveloped nature. These parcels typically require a larger down payment, higher interest rates, and a detailed plan from the borrower explaining how the land will be used or developed.

How Lenders Evaluate Land Loans

Banks and credit unions approach land loans with more caution than traditional home loans. Since undeveloped land can be harder to resell in case of default, lenders often ask for a higher loan-to-value (LTV) ratio. Borrowers are usually required to provide a down payment of 20% to 50%, depending on the land’s characteristics and location.

Creditworthiness plays a major role in loan approval. A solid credit score—generally above 680—will improve your chances, especially when applying for loans through national or regional banks. Additionally, lenders evaluate the land’s marketability, zoning status, access to roads, and whether utilities are available. A professional land appraisal is almost always required to establish the property’s fair market value and determine its feasibility for development.

Financing Options: From Banks to Federal Programs

When it comes to borrowing options, traditional banks are one route, but they aren’t the only game in town. Many borrowers explore financing through credit unions or community banks that are familiar with the local real estate market. These institutions may offer more flexible terms and a better understanding of regional zoning regulations.

Another increasingly popular alternative is owner-financed land, where the seller offers a payment plan directly to the buyer, bypassing financial institutions altogether. While this can be more accessible for those with lower credit scores, interest rates are typically higher, and the legal protections may be fewer unless handled through a title company or attorney.

Government-backed loans can also assist in specific situations. For example, the U.S. Department of Agriculture (USDA) offers financing for land purchases in rural areas, especially for agricultural use or rural housing developments. These USDA loans are beneficial for those who meet specific income and location criteria, offering low-interest rates and reduced down payment requirements.

Combining Land Loans with Construction Loans

If you’re planning to build a home on your land in the near future, you may consider a construction-to-permanent loan. This hybrid option allows you to finance both the purchase of the land and the construction of a structure on it. During the building phase, you typically pay interest only, and once construction is complete, the loan converts into a traditional mortgage.

This approach can be financially efficient and appealing to lenders, as the presence of a permanent structure adds value and security to the property. However, you’ll need to present a detailed construction plan, secure all necessary permits, and undergo periodic inspections throughout the building process.

Legal Considerations and Zoning Laws

Zoning requirements are one of the most overlooked yet critical aspects of land ownership. Before finalizing your purchase or securing a loan, you must verify how the land is zoned—residential, commercial, agricultural, or mixed-use. Zoning laws affect what you can build and how you can use the property, which in turn influences your loan eligibility and development timeline.

It’s also crucial to conduct a title search and purchase title insurance. This ensures that there are no legal disputes, liens, or easements on the property that could interfere with your ownership. A land survey can also confirm boundaries and identify any encroachments, which are often required by lenders as part of the loan approval process.

Understanding Costs, Interest Rates, and Loan Terms

Land loans generally come with higher interest rates than conventional mortgages due to the increased risk. These rates can range from 5% to 10% or more, depending on the borrower’s financial profile and the specifics of the land. Loan terms are often shorter as well, usually spanning 5 to 15 years rather than the 30-year terms commonly seen in home loans.

Borrowers should also factor in additional costs, including property taxes, insurance, surveying fees, and utility installation. Because land doesn’t generate rental income or shelter, the carrying costs must be carefully considered when calculating long-term investment value.

Tips to Improve Your Chances of Approval

To strengthen your loan application, begin by improving your credit score and reducing any outstanding debt. Prepare a comprehensive development plan that outlines your intended use for the land, including timelines, contractor details, and construction budgets if applicable.

Having a higher down payment ready not only improves your chances of approval but can also reduce your interest rate and monthly payments. Choosing land with existing road access and nearby utilities also helps present a lower-risk profile to lenders.

FAQs

Q1: What is the minimum credit score needed to qualify for a land loan?

Most lenders require a credit score of at least 680, although some private lenders may consider lower scores with a higher down payment.

Q2: How much down payment is required to finance land?

Down payments typically range from 20% to 50% of the land’s purchase price, depending on its development status and location.

Q3: Can I get a land loan to build a house later?

Yes. You can apply for a land loan initially and later transition to a construction loan, or combine both through a construction-to-permanent loan.

Q4: Are interest rates higher for land loans?

Yes, they are usually higher than traditional home mortgages due to increased lender risk.

Q5: What type of loan is best for buying rural land?

USDA loans are ideal for rural land if you meet the income and property eligibility criteria. Otherwise, community banks or credit unions may offer specialized rural land financing.

Q6: Can I use land as collateral for another loan?

Yes, if the land is fully owned and has substantial equity, it can be used as collateral for personal or construction loans.

Conclusion

Financing land ownership is both a strategic move and a nuanced process that requires thorough research and preparation. From understanding zoning restrictions and loan-to-value ratios to securing the right type of lender, every step matters. Whether your goal is to build a home, launch an agricultural venture,

BLOG

OHIO CHAMPION TREES LEWIS CENTER OHIO CHAMPION TREES: Discover the Largest Trees in the Buckeye State

Across Ohio, some trees are so large and historically significant that they are officially recognized as champion trees. These remarkable giants represent the biggest known examples of their species in the state—or even the entire country.

If you’re searching for Ohio champion trees in Lewis Center, Ohio, you’re likely exploring where these trees are located, how they are measured, and why they matter to conservation and local history.

This guide explains what champion trees are, how Ohio identifies them, and how communities like Lewis Center connect with these living landmarks.

Why Champion Trees Matter Today

Champion trees are not just big trees—they are living records of ecological history.

Organizations like the National Champion Tree Program and the Ohio Department of Natural Resources (ODNR) track these trees to:

- Protect significant native species

- Promote environmental awareness

- Document forest health and biodiversity

- Encourage community conservation

In the era of AI-powered search and environmental awareness, champion trees are becoming popular topics for:

- eco-tourism

- outdoor education

- local heritage exploration

- biodiversity conservation

For communities such as Lewis Center, Ohio, nearby champion trees highlight the region’s rich natural landscape and long-standing forests.

What Are Ohio Champion Trees?

Ohio champion trees are the largest recorded specimens of a particular tree species in the state.

A tree earns “champion” status through a standardized scoring system based on three measurements:

1. Trunk Circumference

The distance around the tree trunk measured at 4.5 feet above ground.

2. Tree Height

Measured from the base to the highest point of the tree.

3. Crown Spread

The average width of the tree’s canopy.

These values are combined into a point score used to determine which tree holds the title of champion.

How Trees Become Official Champions

The process is coordinated by the Ohio Department of Natural Resources Division of Forestry and the National Champion Tree Program.

Step-by-Step Process

- Tree nomination

Anyone can submit a large tree they believe may qualify. - Field measurement

Forestry experts measure the tree using standardized methods. - Score calculation

Points are calculated from circumference, height, and crown spread. - Verification and listing

If the tree exceeds current records, it becomes the official champion. - Publication

The tree is added to the Ohio Champion Tree Registry and may also be listed nationally.

Champion Trees Near Lewis Center, Ohio

Lewis Center, located in Delaware County, sits in a region with rich woodland ecosystems and historic hardwood forests. While many champion trees are scattered across Ohio, several notable species grow in nearby counties.

Common champion or near-champion species found around central Ohio include:

- White Oak (Quercus alba)

- Tulip Tree (Liriodendron tulipifera)

- Sycamore (Platanus occidentalis)

- Sugar Maple (Acer saccharum)

- American Beech (Fagus grandifolia)

These species thrive in Ohio’s temperate climate and fertile soils, allowing some trees to grow hundreds of years old and extremely large.

For example, a state champion white oak in Athens County has drawn attention for its massive trunk and expansive canopy—showing how large native hardwoods can become when protected over generations.

How to Find Champion Trees in Ohio

If you want to explore Ohio champion trees near Lewis Center, several resources make it easy.

Official Champion Tree Lists

The ODNR Champion Tree Program maintains updated records that include:

- Tree species

- Location (county or park)

- Measurements and scores

- Nomination information

These lists help hikers, researchers, and tree enthusiasts locate notable specimens across the state.

National Champion Tree Register

The National Champion Tree Register tracks the largest known trees in the entire United States.

This program helps identify:

- national champion trees

- co-champions

- emerging contenders

Many Ohio trees compete at the national level due to the state’s diverse forest ecosystems.

Tips for Identifying Large Trees in Your Area

If you live in Lewis Center or nearby central Ohio, you might discover a potential champion tree yourself.

Look for These Signs

- Trunks wider than 10–15 feet in circumference

- Trees significantly taller than surrounding trees

- Massive spreading canopies

- Trees growing in protected areas or historic parks

Use Simple Measuring Methods

You can make a basic evaluation using:

- a measuring tape for trunk circumference

- a smartphone clinometer app for height estimates

- pacing methods for crown spread

If the tree appears exceptional, you can submit a nomination through Ohio’s forestry program.

Why Champion Trees Are Important for Conservation

Champion tree programs serve a larger environmental purpose.

They help:

- protect old-growth specimens

- preserve genetic diversity

- educate communities about forest ecology

- encourage tree planting and stewardship

Large trees also provide critical ecological benefits:

- wildlife habitat

- carbon storage

- soil stabilization

- urban cooling

In growing communities like Lewis Center, preserving these natural giants supports both environmental health and local heritage.

Visiting Large Trees in Central Ohio

Several parks and natural areas near Lewis Center provide opportunities to see large native trees.

Popular places to explore include:

- state nature preserves

- county parks

- historic forest areas

- botanical gardens

When visiting large trees, remember:

- avoid climbing or damaging roots

- stay on designated trails

- respect conservation rules

Champion trees often survive for centuries, so careful protection helps them remain standing for future generations.

The Future of Champion Trees in Ohio

As climate conditions change and urban areas expand, champion tree programs are becoming more important than ever.

Forestry experts now use these trees to study:

- long-term forest resilience

- species adaptation

- environmental change

New champions are also discovered every year as volunteers, arborists, and outdoor enthusiasts explore Ohio’s forests.

That means the next Ohio champion tree could be growing quietly in a neighborhood park, farm field, or woodland near Lewis Center.

Conclusion

Ohio champion trees represent the largest and most remarkable trees in the state. They are identified through careful measurement and recognized by programs run by the Ohio Department of Natural Resources and the National Champion Tree Register.

For residents and nature lovers in Lewis Center, Ohio, these trees offer a fascinating connection to the region’s natural history. Whether you’re exploring forests, learning about native species, or hoping to nominate a new champion, these towering giants remind us how powerful and enduring nature can be.

Protecting and celebrating champion trees ensures that Ohio’s forests—and their most impressive specimens—continue to inspire future generations.

BLOG

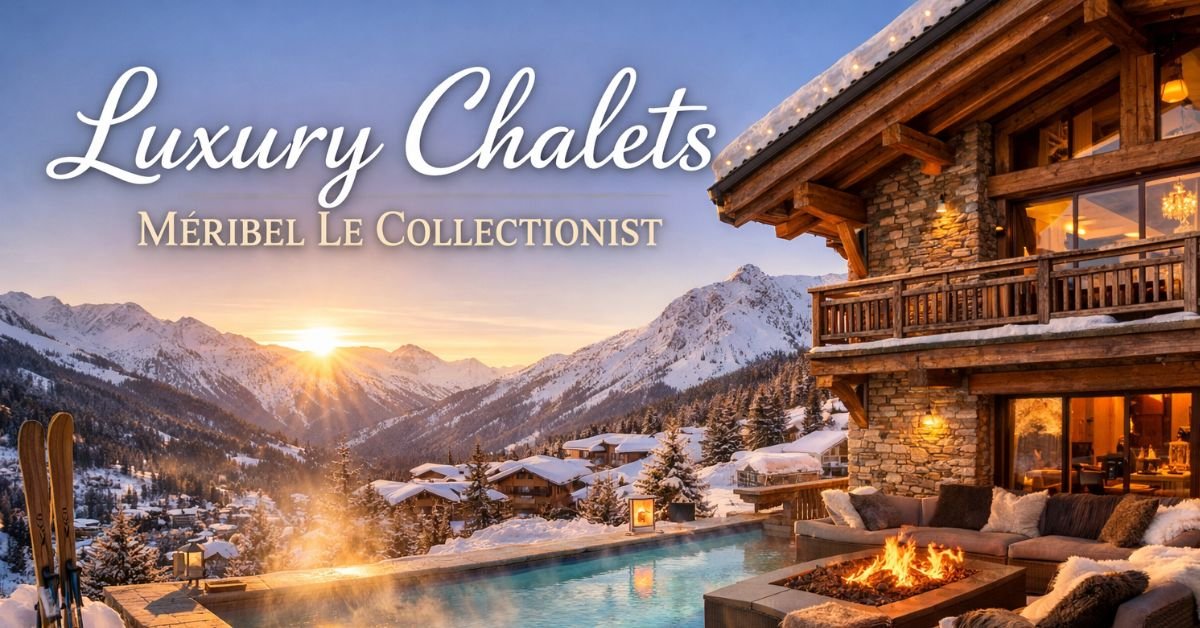

Luxury Chalets Méribel Le Collectionist: A Guide to Premium Alpine Stays

If you are looking for an unforgettable ski holiday in the French Alps, luxury chalets in Méribel by Le Collectionist offer one of the most exclusive ways to experience the mountains. These high-end chalets combine world-class skiing, private hospitality, and five-star comfort in one of Europe’s most famous ski resorts.

Today, travelers want more than just accommodation. They want privacy, personalized service, and memorable experiences. Luxury chalet rentals provide exactly that — a private Alpine retreat with hotel-level services, concierge support, and premium amenities.

This guide explains what Luxury Chalets Méribel Le Collectionist are, why they are popular among high-end travelers, and how to choose the right chalet for your next ski vacation.

Why Luxury Chalet Rentals in Méribel Are So Popular

Short answer: Méribel combines world-class skiing with traditional Alpine charm, making it a perfect location for luxury chalet holidays.

Méribel sits in the heart of Les Trois Vallées, the largest interconnected ski area in the world. This means visitors have access to hundreds of kilometers of ski slopes while enjoying the cozy atmosphere of a classic Alpine village.

Key reasons travelers choose Méribel

- Access to 600 km of ski slopes

- Stunning Alpine scenery

- Authentic wooden chalet architecture

- Michelin-level dining and après-ski culture

- Easy access from Geneva Airport

Because of these advantages, Méribel attracts affluent travelers, families, and celebrities seeking privacy and luxury during the ski season.

Luxury chalet companies like Le Collectionist specialize in curating exceptional properties in this prestigious resort.

What Is Le Collectionist?

Direct answer: Le Collectionist is a luxury vacation rental platform that curates high-end villas and chalets with personalized concierge services.

Unlike standard rental websites, Le Collectionist focuses on carefully selected properties and tailored travel experiences.

What makes Le Collectionist different

- Handpicked luxury chalets

- Dedicated concierge service

- Personalized holiday planning

- Premium hospitality services

- Unique travel experiences

Their portfolio includes luxury homes in destinations such as:

- The French Alps

- The Mediterranean

- Ibiza and Mallorca

- Tuscany

- The Caribbean

For ski holidays, their Méribel chalet collection is particularly popular among travelers seeking privacy and comfort.

What to Expect from Luxury Chalets in Méribel

Short answer: Luxury chalets offer hotel-level amenities with the privacy of a private mountain home.

These chalets are designed for guests who want more space, comfort, and exclusivity than traditional hotels provide.

Typical features include

- Ski-in / ski-out access

- Private spa and wellness areas

- Indoor swimming pools

- Hot tubs and saunas

- Private chefs

- Housekeeping staff

- Cinema rooms

- Panoramic mountain views

Many chalets also include large terraces and fireplaces, creating the classic Alpine atmosphere that Méribel is known for.

Types of Luxury Chalets Available in Méribel

Not all luxury chalets are the same. Travelers can choose from different styles depending on their group size, preferences, and budget.

1. Ski-in Ski-out Chalets

These chalets provide direct access to the ski slopes.

Benefits include:

- No need for transportation

- Easy access for families

- More time on the slopes

This type of property is highly sought after during peak ski season.

2. Chalets with Private Pools

Some high-end properties include indoor heated pools and wellness facilities.

These chalets are ideal for guests who want a spa-like experience after skiing.

Typical wellness amenities include:

- Heated pools

- Steam rooms

- Massage rooms

- Hot tubs with mountain views

3. Large Family Chalets

Families and groups often rent large chalets designed to host 8–16 guests or more.

These properties often include:

- Multiple bedroom suites

- Children’s play areas

- Entertainment rooms

- Private cinema spaces

This setup makes them ideal for multi-generational trips.

Benefits of Booking with Le Collectionist

Direct answer: The main benefit is the combination of luxury accommodation and full-service holiday planning.

Le Collectionist provides more than just a property rental. They create fully curated travel experiences.

Services often included

- Dedicated concierge

- Private chefs

- Airport transfers

- Ski instructors

- Equipment rentals

- Restaurant reservations

- Personalized itineraries

This level of service allows guests to enjoy a stress-free luxury ski holiday.

How to Choose the Right Luxury Chalet in Méribel

Selecting the perfect chalet depends on your travel style and priorities.

Consider these factors

1. Location

- Ski-in ski-out access

- Close to Méribel Centre

- Quiet mountain areas

2. Group size

Choose a chalet with enough bedrooms and shared spaces.

3. Amenities

Popular features include:

- Spa facilities

- Pools

- Cinema rooms

- Mountain views

4. Services

Some chalets include full staff, while others offer services on request.

Best Time to Visit Méribel for a Luxury Ski Holiday

The ski season typically runs from December to April.

Peak periods

- Christmas and New Year

- February school holidays

- March spring skiing

For travelers seeking quieter luxury experiences, January and early March often offer excellent snow conditions with fewer crowds.

Practical Tips for Booking Luxury Chalets

Booking a luxury chalet requires more planning than standard accommodations.

Tips to secure the best property

- Book 6–12 months in advance for peak season

- Confirm included services before booking

- Ask about ski access and transport options

- Work with concierge teams to plan activities early

This ensures the chalet and services match your expectations.

The Future of Luxury Ski Travel

Luxury travel trends are evolving toward privacy, personalization, and experiential travel.

High-end chalet rentals are becoming more popular because they provide:

- Exclusive environments

- Personalized hospitality

- Unique destination experiences

Platforms like Le Collectionist reflect this shift by focusing on curated luxury stays instead of mass-market rentals.

Conclusion

Luxury chalets in Méribel by Le Collectionist represent one of the most refined ways to enjoy the French Alps. With private spaces, premium amenities, and personalized concierge services, these properties transform a simple ski trip into a fully curated luxury experience.

Whether you are traveling with family, friends, or planning a special winter getaway, choosing the right luxury chalet can elevate your holiday significantly.

By understanding what these chalets offer and how to select the right one, travelers can enjoy an unforgettable Alpine escape in one of Europe’s most prestigious ski destinations.

BLOG

Diagnostic Imaging: A Complete Guide to X-Ray, MRI, CT Scan & Ultrasound

Diagnostic imaging also known as medical imaging refers to a range of techniques and processes used to create visual representations of the interior of the human body. These images allow physicians to examine organs, bones, blood vessels, and tissues to detect disease, monitor ongoing conditions, and plan treatments, often without requiring invasive procedures.

Modern diagnostic imaging sits at the intersection of physics, biology, and computer science. Depending on the modality (the specific type of scan), images may be produced using ionizing radiation (X-rays and CT scans), magnetic fields and radio waves (MRI), high-frequency sound waves (ultrasound), or radioactive tracers (PET scans). Each technology has its own strengths, limitations, and ideal use cases.

The images produced are reviewed and interpreted by a radiologist a specialist physician trained to read and report on medical images. The radiologist’s report is then used by your referring doctor to make decisions about your diagnosis and treatment.

The Main Types of Diagnostic Imaging

There are several primary imaging modalities in use today. Each serves a distinct clinical purpose, and understanding the differences can help you feel more informed and less anxious when your doctor recommends a scan.

X-Ray (Radiography)

X-ray is the oldest and most widely used form of medical imaging. It works by passing a small amount of ionizing radiation through the body. Dense structures such as bones absorb radiation and appear white on the image, while softer tissues appear in shades of grey, and air-filled spaces (like the lungs) appear dark.

X-rays are fast, painless, and relatively inexpensive, making them the go-to imaging tool in emergency rooms and primary care settings.

Common uses include:

- Detecting fractures, dislocations, and bone abnormalities

- Diagnosing pneumonia, collapsed lung, or chest infections

- Monitoring bone density and joint conditions such as arthritis

- Identifying foreign objects in the body

- Screening for lung cancer (low-dose CT is now preferred for this)

Radiation dose: Very low. A standard chest X-ray exposes you to approximately the same amount of radiation you would receive from a few hours of natural background radiation.

Computed Tomography (CT Scan)

A CT scan (also called a CAT scan) takes multiple X-ray images from different angles around your body and uses a computer to reconstruct them into detailed cross-sectional images essentially a 3D map of your internal structures. This makes CT scans far more detailed than a standard X-ray, particularly for soft tissues, blood vessels, and complex anatomy.

CT scans are commonly ordered in emergency situations because they are fast and comprehensive. They are also widely used in cancer staging, trauma assessment, and pre-surgical planning.

A contrast dye (contrast material) may be injected into your vein or taken orally before the scan to make certain structures, such as blood vessels or tumors, more visible on the images.

Common uses include:

- Detecting internal bleeding and organ injuries after trauma

- Diagnosing cancer and monitoring treatment response

- Evaluating blood vessels (CT angiography)

- Identifying appendicitis, kidney stones, and bowel obstructions

- Guiding biopsies and other minimally invasive procedures

Radiation dose: Moderate. Higher than a standard X-ray, but still within acceptable safety limits for most patients. Your radiologist and referring doctor weigh the diagnostic benefit against the risk before ordering a CT scan.

Magnetic Resonance Imaging (MRI)

MRI uses a powerful magnetic field and radio waves not radiation to create detailed images of soft tissues, organs, and the nervous system. It is particularly valuable for imaging the brain, spinal cord, joints, ligaments, muscles, and pelvic organs, where it provides far greater soft-tissue contrast than CT or X-ray.

Because MRI does not use ionizing radiation, it is a preferred imaging method for patients who require repeated imaging, pregnant women (especially after the first trimester), and children.

MRI scans are longer than other types of scans, typically taking 30 to 90 minutes. The scanner produces loud knocking and thumping noises, and patients are given ear protection. Some patients experience claustrophobia; if this is a concern, an open MRI machine or mild sedation may be offered.

Important: Because of the powerful magnetic field, all metal implants must be declared before the scan. Pacemakers, cochlear implants, and certain types of metal clips may be contraindications for MRI. Always inform your radiographer of any implants or metal in your body.

Common uses include:

- Brain and spinal cord imaging (strokes, MS, tumors, disc herniation)

- Joint imaging (torn ligaments, cartilage damage, meniscus tears)

- Breast MRI for high-risk cancer screening

- Pelvic imaging (uterus, ovaries, prostate)

- Cardiac MRI for heart structure and function

Ultrasound (Sonography)

Ultrasound imaging uses high-frequency sound waves transmitted through a handheld probe (transducer) placed on the skin. The sound waves bounce off internal structures, and a computer converts the returning echoes into a real-time image on a screen.

Ultrasound is unique in that it produces live, moving images making it ideal for examining blood flow (Doppler ultrasound), assessing fetal development during pregnancy, and guiding needle biopsies. It involves no radiation and is widely considered safe for all patients, including pregnant women and newborns.

Common uses include:

- Obstetric imaging monitoring fetal growth and development

- Abdominal imaging gallbladder stones, liver disease, kidney abnormalities

- Vascular imaging detecting blood clots, arterial stenosis (Doppler)

- Breast ultrasound distinguishing cysts from solid masses

- Guiding biopsies, drain placements, and injections

Limitation: Ultrasound does not produce as detailed images as CT or MRI for deep structures, and image quality can be affected by factors such as body composition and the presence of gas in the bowel.

PET Scan (Positron Emission Tomography)

A PET scan is a form of nuclear medicine imaging that shows how organs and tissues are functioning at a cellular level, rather than simply showing their structure. Before the scan, a small amount of a radioactive tracer (usually a glucose-based compound) is injected into a vein. Cells that are metabolically active such as cancer cells absorb more of the tracer and appear as bright spots on the scan.

PET scans are often combined with CT or MRI (PET-CT or PET-MRI) to provide both functional and structural information in a single session.

Common uses include:

- Cancer diagnosis, staging, and monitoring treatment response

- Evaluating brain function in Alzheimer’s disease, epilepsy, and brain tumors

- Assessing heart muscle viability before cardiac procedures

Quick Comparison: Diagnostic Imaging at a Glance

Use the table below to understand the key differences between imaging types at a glance.

| Imaging Type | Uses Radiation? | Best For | Typical Duration |

| X-Ray | Yes (Low) | Bones, Chest, Lungs | 5–15 minutes |

| CT Scan | Yes (Moderate) | Internal injuries, Cancer | 10–30 minutes |

| MRI | No | Brain, Spine, Soft Tissue | 30–90 minutes |

| Ultrasound | No | Pregnancy, Abdomen, Vascular | 20–45 minutes |

| PET Scan | Yes (Tracer) | Cancer staging, Brain activity | 2–4 hours |

How to Prepare for Your Diagnostic Imaging Scan

Preparation varies depending on the type of scan. Below is a practical checklist for each modality. Your imaging center will also provide specific instructions when you book your appointment always follow their guidance, as protocols can differ.

X-Ray Preparation

- Remove jewellery, piercings, and metal accessories from the area being scanned

- Inform staff if you are pregnant or could be pregnant

- Wear comfortable, loose-fitting clothing you may be asked to change into a gown

- No fasting required (unless combined with another procedure)

CT Scan Preparation

- Do not eat or drink for 4 hours before the scan if contrast dye is being used

- Inform the radiographer of any allergies particularly to iodine or shellfish (relevant to contrast reactions)

- Inform staff if you have kidney problems (contrast dye requires adequate kidney function)

- Remove metal jewellery and accessories

- Inform staff if you are pregnant

MRI Preparation

- Complete a metal screening questionnaire declare all implants, surgical clips, and any metal in or on your body

- Remove all metal objects including piercings, watch, hearing aids, and hairpins

- Inform staff of any pacemaker, cochlear implant, neurostimulator, or metal joint replacement

- Wear comfortable, metal-free clothing or change into a provided gown

- Fasting is generally not required unless abdominal contrast MRI is being performed

- If you experience claustrophobia, inform your doctor in advance open MRI or mild sedation may be available

Abdominal Ultrasound Preparation

- Fast (nothing to eat or drink) for 6–8 hours before the scan this ensures the gallbladder is full and the bowel contains minimal gas

- Take prescribed medications with a small sip of water only

- Avoid chewing gum, as it produces air in the stomach

Pelvic Ultrasound Preparation

- Drink approximately 1 litre of water 1 hour before the scan and do not empty your bladder a full bladder is required for optimal imaging of the uterus and ovaries

- You may be told to empty your bladder for the second part of the scan (transvaginal ultrasound, if performed)

Benefits vs Risks: What You Need to Know

The Benefits of Diagnostic Imaging

Diagnostic imaging has revolutionised the way medicine is practised. Its key benefits include:

- Early detection: Imaging can identify disease at its earliest stages before symptoms appear significantly improving treatment outcomes, particularly in cancer.

- Accurate diagnosis: Imaging provides objective, visual evidence that supports or confirms a clinical diagnosis, reducing the likelihood of misdiagnosis.

- Non-invasive: Most imaging modalities require no incisions, injections (with the exception of contrast-enhanced scans), or recovery time.

- Treatment planning: Surgeons use imaging to plan operations, interventional radiologists use it to guide procedures, and oncologists use it to target radiation therapy precisely.

- Monitoring progress: Repeat imaging allows doctors to track how a condition responds to treatment, whether it is chemotherapy, physiotherapy, or medication.

Understanding the Risks

While diagnostic imaging is generally very safe, it is important to understand the associated risks for informed decision-making.

Radiation exposure: X-rays and CT scans use ionizing radiation. While doses are kept as low as reasonably achievable (following the ALARA principle), repeated exposure over time carries a small cumulative risk. Your doctor will only request a radiation-based scan when the diagnostic benefit outweighs this risk.

Contrast reactions: Contrast dye used in CT and MRI scans can occasionally cause allergic reactions. Mild reactions (flushing, nausea) are relatively common; severe anaphylactic reactions are rare but possible. Patients with known allergies or kidney problems should always inform their medical team.

MRI and implants: The magnetic field used in MRI can interact with certain metal implants or devices, potentially causing movement, heating, or malfunction. Thorough screening before every MRI scan is essential.

Pregnancy considerations: Ionising radiation should be avoided during pregnancy where possible, particularly in the first trimester. Ultrasound and MRI (after the first trimester) are generally considered safe alternatives.

Frequently Asked Questions

What is the difference between an MRI and a CT scan?

Both MRI and CT scans produce detailed cross-sectional images of the body, but they work differently. CT uses X-ray radiation and is faster and better suited for dense structures, trauma, and emergencies. MRI uses magnetic fields and radio waves (no radiation) and provides superior detail of soft tissues such as the brain, spinal cord, and joints. Your doctor will choose the most appropriate scan based on what they need to evaluate.

Does a CT scan use more radiation than an X-ray?

Yes. A CT scan uses significantly more radiation than a standard X-ray because it captures hundreds of cross-sectional images from multiple angles. However, the radiation dose is still within safe medical limits and is justified by the far greater diagnostic detail it provides. Your imaging team follows strict protocols to minimise your exposure.

Can I eat or drink before an ultrasound?

It depends on the type of ultrasound. For an abdominal ultrasound (examining the liver, gallbladder, pancreas, and kidneys), you will usually need to fast for 6–8 hours beforehand. For a pelvic ultrasound, you will need to have a full bladder. For other types such as a thyroid or vascular ultrasound no preparation is usually required. Your imaging centre will give you specific instructions when you book.

How long does an MRI take?

Most MRI scans take between 30 and 90 minutes, depending on the body area being scanned and whether contrast is used. You must remain very still inside the scanner throughout. The machine is loud you will be given earplugs or headphones. If you feel anxious or claustrophobic, inform the radiographer before the scan begins; they can pause the scan or adjust the pace if needed.

Is diagnostic imaging painful?

In most cases, no. The scans themselves are painless. You may experience mild discomfort from lying still for an extended period during an MRI, or a brief warm or flushing sensation when contrast dye is injected for a CT scan. Biopsy procedures guided by imaging involve local anaesthetic and may cause some discomfort.

Why do I need contrast dye?

Contrast material (dye) is used in some CT and MRI scans to make certain structures such as blood vessels, tumours, and areas of inflammation more visible. Without contrast, these features may be difficult to distinguish from surrounding tissue. Your doctor or radiologist will request contrast when it will meaningfully improve the diagnostic quality of the scan.

Can I have an MRI if I have a pacemaker?

Many modern pacemakers are now MRI-conditional, meaning they can be safely scanned under specific conditions and with specialist supervision. However, older devices may not be compatible. You should always inform your doctor and the imaging centre about your pacemaker before any MRI is arranged. The imaging team will verify the device model and consult with your cardiologist if necessary.

How much does a diagnostic imaging scan cost?

Costs vary widely depending on the type of scan, location, and whether you are covered by insurance. In the United States, an X-ray typically costs between $100 and $1,000 without insurance; a CT scan between $500 and $3,000; and an MRI between $400 and $12,000 depending on the area of the body. Many scans are covered partially or fully by health insurance if medically necessary. Always check with your insurance provider before your appointment, and ask your imaging centre about self-pay discounts.

What should I wear to my imaging appointment?

Wear comfortable, loose-fitting clothes without metal zippers, underwire, or metal fastenings particularly for MRI. You may be asked to change into a hospital gown. Leave jewellery and accessories at home whenever possible. For MRI specifically, wear clothing you do not mind potentially being asked to remove, as any metal items must be taken off before entering the scanner room.

Finding a Qualified Imaging Centre

Not all imaging facilities are created equal. When choosing where to have your scan, look for the following quality indicators:

- ACR Accreditation: The American College of Radiology (ACR) accredits imaging facilities that meet rigorous standards for equipment, safety, and the qualifications of staff. Look for the ACR gold seal on any facility’s website.

- IAC Accreditation: For ultrasound and vascular testing, accreditation from the Intersocietal Accreditation Commission (IAC) is a mark of quality.

- Board-certified radiologists: Ensure that a qualified, board-certified radiologist will read and report on your scan. Teleradiology is common, but reports should always be reviewed by a physician.

- Modern equipment: Ask whether the facility uses up-to-date, well-maintained equipment. Older scanners may produce lower-quality images.

- Outpatient imaging centres vs. hospitals: Hospital radiology departments and dedicated outpatient imaging centres both offer high-quality scans. Outpatient centres often have shorter waiting times and lower costs. Your GP or specialist can recommend a reputable facility in your area.

Conclusion

Diagnostic imaging is one of the most powerful tools in modern medicine. From the speed of an emergency X-ray to the extraordinary detail of a brain MRI, imaging technologies give clinicians the ability to diagnose faster, plan more precisely, and monitor treatment with unparalleled accuracy.

If your doctor has recommended an imaging scan, it is natural to have questions and perhaps some anxiety. Understanding what the scan is, why it has been ordered, and how to prepare can make a significant difference to your experience. The imaging team from the radiographer who performs the scan to the radiologist who interprets it is there to support you throughout the process.

Always consult your doctor if you have concerns about a recommended scan. And if you have been waiting for imaging you believe is necessary, do not hesitate to raise it at your next appointment. Early, accurate imaging can be life-changing.

-

TECH8 months ago

TECH8 months agoApple iPhone 17: Official 2025 Release Date Revealed

-

BLOG8 months ago

BLOG8 months agoUnderstanding the ∴ Symbol in Math

-

ENTERTAINMENT6 months ago

ENTERTAINMENT6 months agoWhat Is SUV? A Family-Friendly Vehicle Explained

-

EDUCATION1 week ago

EDUCATION1 week agoHorizontal Translation: How to Shift Graphs

-

EDUCATION8 months ago

EDUCATION8 months agoUsing the Quadratic Formula

-

EDUCATION8 months ago

EDUCATION8 months agoThe Meaning of an Open Circle in Math Explained

-

ENTERTAINMENT8 months ago

ENTERTAINMENT8 months agoGoing Live: How to Stream on TikTok from Your PC

-

EDUCATION8 months ago

EDUCATION8 months agoWhy Does m Represent Slope?